Tax scammers are back! But this year, you've got a new tool to spot them

Tax refund scams are rising in February and March, with scammers taking advantage of the tax season and people's expectations for communication with IRS officials.

Each year, the U.S. Internal Revenue Service (IRS) warns people to be vigilant and protect their money and digital identity.

These scams typically involve criminals impersonating IRS agents, government employees, or debt collectors through various channels such as phone calls, texts, online messages, or mail. They aim to deceive individuals into sending money for fake taxes, penalties, or fees or providing access to their tax funds or personal information.

Once fraudsters have your information, they can collect a refund in your name and use or sell your personal information for other frauds.

Tax refund scams can take various forms, as scammers come up with new schemes to trick people, but commonly, they start with an email.

The IRS doesn't send tax refunds by email or text. Scammers do.

IRS's warning for this year is straightforward: "Got an email or text message about a tax refund? It's a scam."

However, sometimes, amidst the stress of reporting income, we may overlook warning signs and inadvertently respond to a bogus email or SMS simply because of its timing.

Here are some examples of the most common email tax scams you should know about:

1."We need you to confirm the information you provided."

Scammers may send phishing emails asking you to verify information. Clicking on the link directs you to a page resembling the IRS website, but any information you provide, such as your SSN or card number, goes directly to the scammers.

2. "We recalculated your tax refund, and you must fill out this form."

Scam emails with subject lines like "Tax Refund Payment" or "Recalculation of your tax refund payment" will ask you to provide personal information to claim your refund. Some variations promise a large and unexpected tax refund.

3."We need you to fill out this tax form."

You may receive an email requesting you to fill out additional tax forms like W-9 or W-4 to calculate your tax. Again, this is the scammers' attempt to bypass your vigilance and obtain valuable data.

4. "Your SSN will be suspended" SMS or email.

Scammers threaten to suspend your Social Security number due to a tax issue. Ignore these threats; your SSN can't be suspended, canceled, frozen, or revoked.

5. "Your refund was too high; you must return extra money."

After receiving a refund, scammers pose as IRS agents and claim your rebate was too high, requiring you to return the extra money. They may request payment via wire transfer or gift cards. Be cautious; the IRS communicates payment requests by mail and offers multiple payment options.

Did you know?

Every year, the IRS makes a list of common scams taxpayers may encounter. It's called The Dirty Dozen, and it gathers represents the worst of the worst tax scams. Many of these schemes peak during tax filing season as people prepare their returns or hire someone to help with their taxes.

Check the 2023 edition and stay safe:

https://www.irs.gov/newsroom/dirty-dozen

How to spot a tax scam

Carefully examine the method of communication first. Most scams start with an email or a text – communication mediums the IRS almost never uses. Official IRS communication is most often handled through the mail.

If you receive an unexpected text, email, or phone call claiming to come from the IRS, don't respond. Instead, take these two steps for your safety:

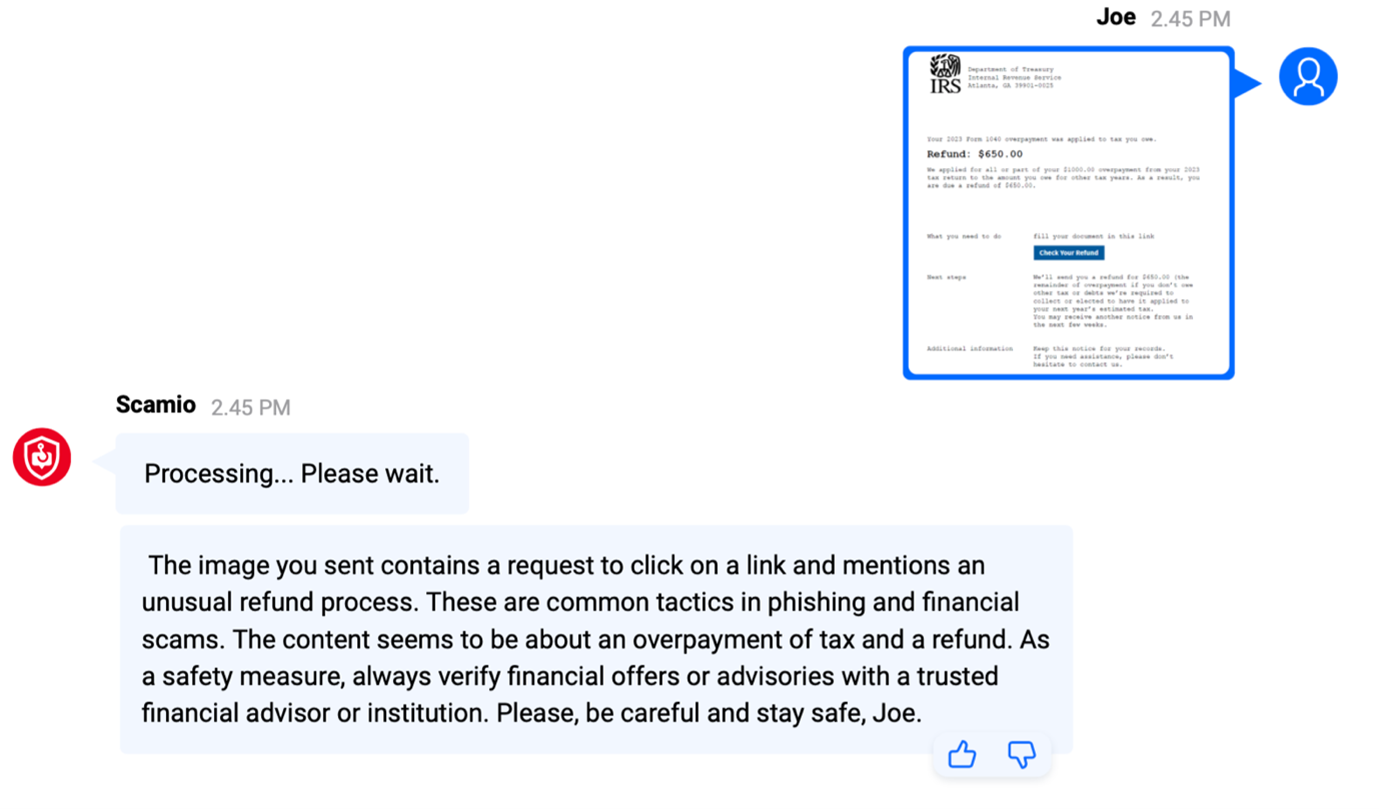

Use Bitdefender Scamio, our next-gen AI scam detector, to check whether it's a scam. You can copy-paste the message, upload an image, send a link, or describe your situation, and Scamio analyzes it and informs you if it's safe.

For example:

2. Contact the IRS directly to verify any contact, not a number in an email or text.

Read more tips to protect yourself from tax scams this year.

Report scams and spread the word throughout your community

As part of the Dirty Dozen awareness effort, the IRS encourages people to report scammers and abusive tax schemes. You can report all unsolicited emails claiming to be from the IRS to phishing@irs.gov.

If you've experienced any financial losses due to an IRS-related incident, report it to the Treasury Inspector General Administration (TIGTA) and the Federal Trade Commission.

Talk to your friends and family about tax scams and what scammers are up to. Share trusted tools such as Bitdefender Scamio with people you care about to help them stay safe. It's free, easy to use, and can save everybody a lot of trouble.

tags

Author

Cristina is a freelance writer and a mother of two living in Denmark. Her 15 years experience in communication includes developing content for tv, online, mobile apps, and a chatbot.

View all postsRight now Top posts

Start Cyber Resilience and Don’t Be an April Fool This Spring and Beyond

April 01, 2024

Spam trends of the week: Cybercrooks phish for QuickBooks, American Express and banking accounts

November 28, 2023

FOLLOW US ON SOCIAL MEDIA

You might also like

Bookmarks